In situations where goods are produced in small volume or on a customized basis, there may be little point in tracking this variance, since the work environment makes it difficult to create standards or reduce labor costs. Actual labor costs may differ from budgeted costs due to differences in rate and efficiency. Labor yield variance arises when there is a variation in actual output from standard.

Do you already work with a financial advisor?

Regular analysis helps in promptly identifying new variances and addressing them before they escalate. Additionally, continuous improvement initiatives, such as enhancing training programs, optimizing workflows, and maintaining favorable working conditions, can lead to sustained productivity gains and cost savings. By implementing these best practices, companies can effectively manage labor variances, reduce costs, and improve productivity. Focusing on both labor rate and labor efficiency variances ensures a comprehensive approach to labor cost management, leading to better financial performance and operational success.

7 Direct Labor Variances

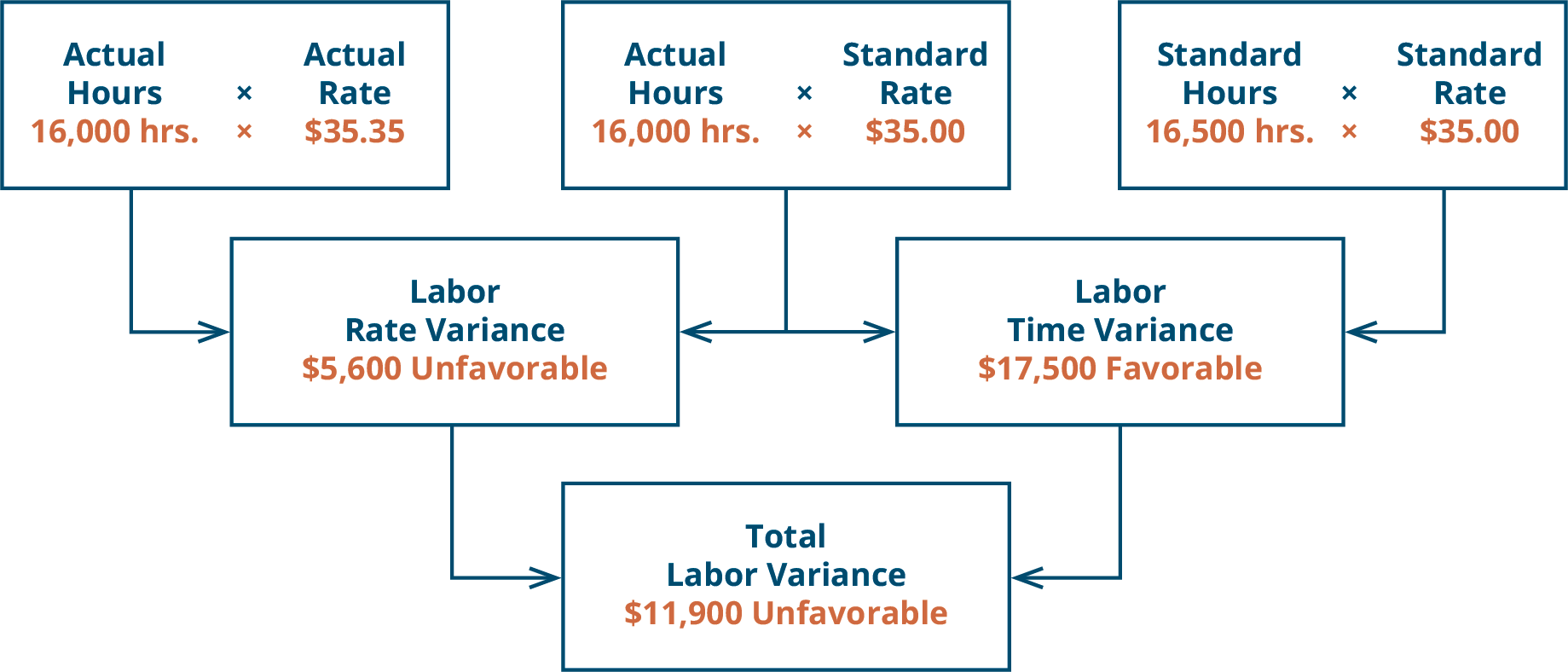

Labor rate variance is a measure used in cost accounting to evaluate the difference between the actual hourly wage rate paid to workers and the standard hourly wage rate that was anticipated or budgeted. This variance highlights whether the company is paying more or less for labor than expected, providing insights into the efficiency of labor cost management. In other words, when actual number of hours worked differ from the standard number of hours allowed to manufacture a certain number of units, labor efficiency variance occurs.

How to Interpret Favorable vs. Unfavorable Variances

If the cost of labor includes benefits, and the cost of benefits has changed, then this impacts the variance. If a company brings in outside labor, such as temporary workers, this can create a favorable labor rate variance because the company is presumably not paying their benefits. If the total actual cost incurred is less than the total standard cost, the variance is favorable. Note that both approaches—the direct labor efficiency variancecalculation and the alternative calculation—yield the sameresult.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- If the outcome is favorable, the actual costs related to labor are less than the expected (standard) costs.

- The total actual cost direct labor cost was $1,550 lower than the standard cost, which is a favorable outcome.

- Outcome By addressing these issues, Company A was able to reduce its unfavorable labor rate variance significantly in subsequent quarters, achieving better cost control and financial stability.

Comprehensively understanding and managing direct labor variance is essential for maintaining cost control, improving operational efficiency, and enhancing overall profitability. By regularly analyzing labor variances, businesses can identify opportunities for improvement and ensure that they tax refund fraud are making the most efficient use of their labor resources. Because Band made 1,000 cases of books this year, employees should have worked 4,000 hours (1,000 cases x 4 hours per case). However, employees actually worked 3,600 hours, for which they were paid an average of $13 per hour.

If, however, the actual hours worked are greater than the standard hours at the actual production output level, the variance will be unfavorable. An unfavorable outcome means you used more hours than anticipated to make the actual number of production units. In this case, the actual rate per hour is $7.50, the standard rate per hour is $8.00, and the actual hour worked is 0.10 hours per box. This is a favorable outcome because the actual rate of pay was less than the standard rate of pay. As a result of this favorable outcome information, the company may consider continuing operations as they exist, or could change future budget projections to reflect higher profit margins, among other things. With either of these formulas, the actual rate per hour refers to the actual rate of pay for workers to create one unit of product.

ABC Company has an annual production budget of 120,000 units and an annual DL budget of $3,840,000. Four hours are needed to complete a finished product and the company has established a standard rate of $8 per hour. This information gives the management a way tomonitor and control production costs. Next, we calculate andanalyze variable manufacturing overhead cost variances. If the actual hours worked are less than the standard hours at the actual production output level, the variance will be a favorable variance. A favorable outcome means you used fewer hours than anticipated to make the actual number of production units.

Positive working conditions and high morale can boost productivity, leading to favorable variances. Poor working conditions and low morale can reduce efficiency, resulting in unfavorable variances. By analyzing labor rate variance, companies can determine if they are paying more or less for labor than expected and identify areas where wage cost control measures may be needed. In addition, the difference between the actual and standard rates sometimes simply means that there has been a change in the general wage rates in the industry. Another element this company and others must consider is a direct labor time variance. By exploring these resources, readers can gain a deeper understanding of labor variances and their role in cost management, further enhancing their knowledge and application of these concepts in a business context.

With either of these formulas, the actual hours worked refers to the actual number of hours used at the actual production output. The standard hours are the expected number of hours used at the actual production output. If there is no difference between the actual hours worked and the standard hours, the outcome will be zero, and no variance exists. Like direct labor rate variance, this variance may be favorable or unfavorable.

The human resources manager of Hodgson Industrial Design estimates that the average labor rate for the coming year for Hodgson’s production staff will be $25/hour. This estimate is based on a standard mix of personnel at different pay rates, as well as a reasonable proportion of overtime hours worked. Direct labor rate variance arise from the difference in actual pay rate of laborers versus what is budgeted.

Recent Comments